1.Annual Meeting of Shareholders | The 2020 Annual Meeting of Shareholders of

EnPro Industries, Inc. will be held at: | 5605 Carnegie Boulevard, Suite 500,

Charlotte, North Carolina 28209 | Wednesday, April 29, 2020 at 11:30 a.m. | | | | | Proxy voting options Your vote is important! Whether or not you expect to attend our shareholder’s meeting, we urge you to vote your shares. You may vote by phone, via the Internet, or by signing, dating, and returning the enclosed proxy card or voting instruction form at your earliest convenience. Your prompt vote will ensure the presence of a quorum at the meeting and will save us the expense and extra work of additional solicitation. If you vote now and later decide to change your vote or to vote your shares at the meeting, you may do so by following instructions found elsewhere in this proxy statement. Your vote by proxy is revocable at your option any time prior to the meeting. The fastest and most convenient way to vote your shares is by the Internet or telephone, using the instructions on this page. Internet and telephone votes are immediately confirmed and tabulated, and reduce postage and proxy tabulation costs. If you prefer to vote by mail, please return the enclosed proxy card or voting instruction form in the addressed, prepaid envelope we have provided. Do not return the paper ballot if you vote via the Internet or by telephone. | | Vote by Internet www.proxyvote.com

Internet voting is available 24 hours a day, 7 days a week.

Instructions: 1.Read our Proxy Statement. |

2. | Go to the following website:www.proxyvote.com |

3. | Have your proxy card or voting instruction form in hand and follow the instructions. You can also register to receive all future shareholder communications electronically, instead of in print. Our annual report, Proxy Statement, and other correspondence will be delivered to you viae-mail if you elect this option. |

Vote by telephone

Vote by telephone 1-800-690-6903via touch tone phone

Telephonic voting is available toll-free 24 hours a day,

7 days a week.

Instructions: 1.1-800-690-6903 via touch tone phone Telephonic voting is available toll-free 24 hours a day, 7 days a week.

Instructions:

1. | Read our Proxy Statement. |

2. | Call toll-free1-800-690-6903.. |

3. | Have your proxy card or voting instruction form in hand and follow the instructions. | | | | |

i

Table of Contents iii ii

5605 Carnegie Boulevard, Suite 500

Charlotte, North Carolina 28209

Letter from our President and Chief Executive Officer Dear Shareholder: On behalf of the board of directors and management of EnPro Industries, Inc., I invite you to our annual meeting of shareholders. It will be held at The Sanctuarythe company’s headquarters located at Kiawah Island, One Sanctuary Beach Drive, Kiawah Island, South5605 Carnegie Boulevard, Suite 500, Charlotte,

North Carolina, 29455, on Wednesday, April 26, 201729, 2020 at 11:30 a.m. This year, our shareholders will be asked to: •Elect as directors the eightnine nominees whose qualifications and experience are described in our proxy statement. •Approve on an advisory basis the compensation paid to our named executive officers as disclosed in our proxy statement. Select on an advisory basis•Approve the frequency of future shareholder advisory votes to approve the compensation of our named executive officers.

EnPro Industries, Inc. 2020 Equity Compensation Plan.Approve our amended and restated Senior Executive Annual Performance Plan as described in our proxy statement.

Approve our amended and restated Long-Term Incentive Plan as described in our proxy statement.

•Ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017. 2020.•Consider any other business that properly comes before the meeting or any adjournment of the meeting. The business of the meeting, including each of the sixfour proposals you are being asked to vote on, is described in detail in the attached Notice of Annual Meeting of Shareholders and Proxy Statement which follows. Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the meeting. Please vote promptly. You may submit your proxy via the Internet, by phone, or by signing, dating, and returning the enclosed proxy card in the enclosed envelope. If you attend the Annual Meeting,annual meeting, you will be able to vote in person, even if you have previously submitted your proxy. Sincerely,

Stephen E. Macadam

Marvin A. Riley

President and Chief Executive Officer March 23, 201726, 2020 iv iii

5605 Carnegie Boulevard, Suite 500

Charlotte, North Carolina 28209

Notice of 20172020 Annual Meeting of Shareholders | | Date: | April 29, 2020 | | Date:Time:

| April 26, 2017 |

Time:

| 11:30 a.m. Eastern Time |

| | Place: | The Sanctuary at Kiawah Island5605 Carnegie Boulevard, Suite 500, Charlotte, North Carolina 28209 |

One Sanctuary Beach Drive

Kiawah Island, South Carolina 29455

| | Record date: | March 9, 2017.13, 2020. Only shareholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the annual meeting. |

| | Proxy voting: | Important. Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form will save the expenses and extra work of additional proxy solicitation. If you wish to vote by mail, we have enclosed an addressed envelope, postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares at the meeting. Your proxy is revocable at your option. |

| | Items of business: | • | | To elect eightnine directors from the nominees described in the accompanying proxy statement•To adopt a resolution approving, on an advisory basis, the compensation paid to our named executive officers as disclosed in the accompanying proxy statement •To approve the EnPro Industries, Inc. 2020 Equity Compensation Plan •To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020 •To transact other business that may properly come before the annual meeting or any adjournment of the meeting |

To adopt a resolution approving, on an advisory basis, the compensation paid to our named executive officers as disclosed in the accompanying proxy statement

To select, on an advisory basis, the frequency of future shareholder advisory votes to approve the compensation of our named executive officers

To approve our amended and restated Senior Executive Annual Performance Plan as described in the accompanying proxy statement

To approve our amended and restated Long-Term Incentive Plan as described in the accompanying proxy statement

To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017

To transact other business that may properly come before the annual meeting or any adjournment of the meeting

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 26, 2017:29, 2020:The proxy statement and 20162019 annual report to shareholders are available at:http:

https://www.enproindustries.com/www.enproindustries.com/shareholder-meeting. By Order of the Board of Directors,

Robert S. McLean

Secretary

March 23, 201726, 2020 1 iv

| | EnPro Industries, Inc.

2017 Proxy Statement

|

EnPro Industries, Inc.

2020 Proxy Statement This summary highlights information contained elsewhere in our proxy statement. Because the summary does not contain all of the information you should consider, you should read the entire proxy statement carefully before voting. Annual meeting of shareholders Time, Place and Voting Matters

| | | Date: | | April 26, 2017 | | | Time: | | 11:30 a.m. Eastern Time | | | Place: | | The Sanctuary at Kiawah Island

One Sanctuary Beach Drive

Kiawah Island, South Carolina 29455

| | | Record date: | | March 9, 2017 | | | Voting: | | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. |

Time, place and voting matters Date:April 29, 2020 Time:11:30 a.m. Eastern Time Place:5605 Carnegie Boulevard, Suite 500 Charlotte, North Carolina 28209 Record date:March 13, 2020 Voting:Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each

director nominee and one vote for each

of the proposals to be voted on. Meeting agenda •Election of eightnine directors •Advisory vote to approve executive compensation Advisory vote to select the frequency of future shareholder advisory votes to approve executive compensation

•Approval of our amended and restated Senior Executive Annual Performancethe EnPro Industries, Inc. 2020 Equity Compensation Plan as described in this proxy statement Approval of our amended and restated Long-Term Incentive Plan as described in this proxy statement

•Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017 2020•Transact other business that may properly come before the meeting See “General information—How do I vote?” (page 8) for more information. In addition to attending the annual meeting, shareholders of record can vote by any of the following methods: | | | | | | | By Internet at www.proxyvote.com | | By telephone at 1-800-690-6903 | | By mailing your proxy card |

If you hold your EnPro shares in street name through an account with a bank, broker or other nominee, your ability to vote by Internet or telephone depends on the voting process of the bank, broker or other nominee through which you hold the shares. Please follow their directions carefully. | | | Proposal | | Board vote recommendation | | | Election of directors (see page 13)14) | | “For” each director nominee | | | Advisory vote to approve executive compensation (see page 54) | | “For” | | | Advisory vote to select the frequency of future shareholder advisory votes to approve executive (see page 56)

| | For every “1 Year” | | | Approval our amended and restated Senior Executive Annual Performance Plan as described in this proxy statement (see page 57)

| | “For” | | | Approval of our amended and restated Long-Term Incentivethe EnPro Industries, Inc. 2020 Equity Compensation Plan as described in this proxy statement (see page 61)56) | | “For” | | | Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 20172020 (see page 66)62) | | “For” |

See “Proposal 1 — 1—Election of directors” (page 13)14) and “Corporate governance policies and practices” (page 19)20) for more information. The board of directors recommends that you vote “For” each nominee listed in the table below, which provides summary information about each nominee. A full description of each nominee’s skills and qualifications begins on page 14.15. Each director is elected annually. Current director, Gordon D. Harnett, who serves as Chairman of the Board of Directors and chairs the Nominating Committee, will be retiring from the board of directors at the annual meeting, at which time the size of the board of directors will be reduced from nine to eight.

| | | | | | | | | | Name | Age | Director

since | Occupation | Independent | Other

public

boards | Committee memberships | AC | CC | NC | EC | Marvin A. Riley | 45 | 2019 | President and Chief Executive Officer, EnPro | No | 1 | | | | C | Thomas M. Botts | 65 | 2012 | Retired Executive VP, Global Manufacturing, Shell Downstream Inc. | Yes | 1 | M | C | M | M | Felix M. Brueck | 64 | 2014 | Director Emeritus, McKinsey & Company, Inc. | Yes | — | M | M | M | | B. Bernard Burns, Jr. | 71 | 2011 | Former Managing Director,

McGuire Woods Capital Group | Yes | — | C | M | M | M | Diane C. Creel | 71 | 2009 | Retired Chairman, CEO and President, Ecovation, Inc. | Yes | 2 | M | M | M | | Adele M. Gulfo | 57 | 2018 | Chief Business and Commercial Development Officer of Sumitovant Biopharma | Yes | 2 | M | M | M | | David L. Hauser* | 68 | 2007 | Former Chairman and CEO,

FairPoint Communications | Yes | 1 | M | M | C | M | John Humphrey | 54 | 2015 | Former Executive Vice President and Chief Financial Officer,

Roper Technologies, Inc. | Yes | 2 | M,F | M | M | | Kees van der Graaf | 69 | 2012 | Former member of the board and executive committee, Unilever NV

and Unilever PLC | Yes | 2 | M | M | M | |

| | | | | | AC | — | Audit and Risk Management Committee | C | — | Committee Chair | CC | — | Compensation and Human Resources Committee | M | — | Member | NC | — | Nominating and Corporate Governance Committee | F | — | Financial expert | EC | — | | | | | | | | | | | | | | | | | | | | | | | | Name | | Age | | | Director

since | | | Occupation | | Inde-

pendent | | Other public boards | | Committee memberships | | | | | | | | AC | | CC | | NC | | EC | | | | | | | | | | | Stephen E. Macadam | | | 56 | | | | 2008 | | | President and CEO, EnPro | | No | | 1 | | | | | | | | C | | | | | | | | | | | Thomas M. Botts | | | 62 | | | | 2012 | | | Retired Executive VP, Global Manufacturing, Shell Downstream Inc. | | Yes | | 1 | | M | | C | | M | | M | | | | | | | | | | | Felix M. Brueck | | | 61 | | | | 2014 | | | Director Emeritus, McKinsey & Company, Inc. | | Yes | | — | | M | | M | | M | | | | | | | | | | | | | B. Bernard Burns, Jr. | | | 68 | | | | 2011 | | | Managing Director, McGuire Woods Capital Group | | Yes | | — | | M | | M | | M | | | | | | | | | | | | | Diane C. Creel | | | 68 | | | | 2009 | | | Retired Chairman, CEO and President, Ecovation, Inc. | | Yes | | 2 | | M | | M | | M | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | David L. Hauser | | | 65 | | | | 2007 | | | Former Chairman and CEO, FairPoint Communications | | Yes | | 1 | | C | | M | | M | | M | | | | | | | | | | | John Humphrey | | | 51 | | | | 2015 | | | Executive Vice President and Chief Financial Officer of Roper Technologies, Inc. | | Yes | | — | | M,F | | M | | M | | | | | | | | | | | | | Kees van der Graaf | | | 66 | | | | 2012 | | | Former member of the board and executive committee, Unilever NV and Unilever PLC | | Yes | | 2 | | M | | M | | M | | |

AC — Audit and Risk Management Committee

CC — Compensation and Human Resources Committee

NC — Nominating and Corporate Governance Committee

EC — Executive Committee

| * | — | Chairman of the Board of Directors |

C — Chair

M — Member

F — Financial expert

Our nominees’ experience and qualifications Our board of directors and its Nominating and Corporate Governance Committee believe broad and diverse experience and varying lengths of tenure are critical elements of a highly functioning board. The board’s experience enables it to make sound decisions that

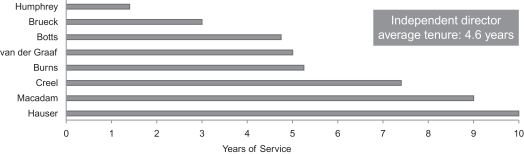

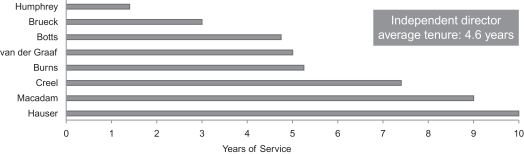

support shareholder value, while the varying tenures of its members provide a balance of institutional knowledge and fresh perspectives. The following charts reflect the tenure of our current directors and the experience and qualifications of the nominees for election as directors. Tenure of Director Nominees3

Director Nominee Experience and Qualifications | | | | | | | | | | | | | | | | | | | | | | | | | | Experience/Qualifications | | Botts | | Brueck | | Burns | | Creel | Gulfo | Hauser | | Humphrey | Riley | Macadam | | van der Graaf | | | | | | | | | | Finance/Accounting | | | ✓ | ✓ | | ✓ | ✓ | ✓ | | ✓ | | ✓ | | ✓ | | | | | | | | | | | | Government/Regulatory | ✓ | ✓ | ✓ | | ✓ | ✓ | | | | ✓ | | | | | | | | | | | | | | | | Legal/Corporate Governance | | | ✓ | ✓ | | ✓ | ✓ | ✓ | | | | ✓ | | ✓ | | | | | | | | | | | | Human Resources/Compensation | | ✓ | | ✓ | | ✓ | | ✓ | | | | | | ✓ | | ✓ | | | | | | | | | | International ExperienceHuman Resources/Compensation

| ✓ | ✓ | ✓ | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | | | | | | | International Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | M&A/Business Development | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | | | | | | | Manufacturing/Operations | ✓ | ✓ | ✓ | ✓ | | ✓ | ✓ | ✓ | | | | ✓ | | ✓ | | ✓ | | | | | | | | | | Sales/Marketing | | ✓ | | ✓ | ✓ | | | ✓ | | | | | | | | ✓ | | | | | | | | | | Strategic Planning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | | | | | | | Technical Innovation/Product Development | | ✓ | | ✓ | ✓ | | | ✓ | | | | | | | | ✓ |

Corporate governance matters Our board of directors and management firmly embrace good and accountable corporate governance. We believe an attentive board, held to the highest standards of corporate governance, is a tangible advantage for our shareholders and for our businesses. Our board makes substantial efforts to meet such standards. Board refreshment balances experience with fresh insights. We seek to balance directors who know and understand our company with those who bring fresh perspectives to governance and management and to expand the diversity of our board. The range of tenure of our independent directors is 1.4 years to 13 years. We elect all directors annually to one-year terms. one-year terms.Annual elections allow shareholders to review each director’s skills and experience and approve his or her nomination at each annual meeting. Our directors must be elected by majority vote. Any nominee in an uncontested election who receives more “withhold” votes than votes “for” must promptly offer his or her resignation. The Nominating and Corporate Governance Committee will consider the resignation and recommend either accepting it or rejecting it to the board, which will act within 90 days after the shareholders’ meeting. The resigning director will not participate in these discussions. The chairman of our board of directors is independent. The position of Chairman of the Board of Directors at EnPro Industries is anon-executive position. An independent director hasIndependent directors have held this position since the inception of our company in 2002. Our CEO Since the Chairman of the Board is the only EnPro employee on our board. Our Chief Executive Officer is normally the only employee

whoindependent, he functionally serves as aour lead independent director. No employee except the Chief Executive Officer has ever been a member of our board.

Our independent directors meet regularly in executive session.Ournon-management directors meet regularly without members of management present. These sessions are presided over by the Chairman of the Board of Directors. Our directors are required to own our company’s stock.Our directors are required to own shares in our company equal in value to five times the annual cash retainer they receive. New directors have five years from the time they join the board to accumulate these shares. All currentof the directors who have served on the board for at least five years or more meet this requirement. Board refreshment balances experience with fresh insights. We seek to balance directors who know and understand our company with those who bring fresh perspectives to governance and management. The average tenure of our independent directors is 4.6 years.

The board and each committee perform comprehensive annual evaluations. Evaluations allow our directors to assess their effectiveness at both the committee and the board level and include an individual director assessment component to permit each director to evaluate the contributions of each of the other directors. For more information, see “Compensation discussion and analysis,” (page 26)28) “Executive compensation” (page 41) and “Proposal 2 — 2—Advisory vote approving executive compensation” (page 54). Our board of directors recommends that you vote “For” our advisory proposal on executive compensation. Thenon-binding, advisory vote gives our shareholders the opportunity to approve the compensation paid to individuals identified as named executive officers in this proxy statement. Our compensationcompensation practices Our programs are designed to reward success Our compensation programs enable us to align the interests of our executive officers with the interests of our shareholders and to reward our executives for superior performance. This practice allows us to attract and retain talented and highly motivated executive officers who are capable of driving our success and building value for our shareholders. Our executive officers’ compensation: •Is tied to business performance—disappointing performance results in little or no payout while superior performance leads to superior payouts; • | | Is tied to business performance. As an executive officer’s level of responsibility increases, a higher percentage of the officer’s total compensation opportunity is based on our financial performance; |

•Is significantly stock-based; • | | Is significantly stock-based. Stock-based compensation ensures our executives and our shareholders have common interests; |

•Vests over several years; • | | Vests over several years.Vesting a meaningful portion of our executives’ total compensation over a period of years aligns their interests with the long-term interests of our shareholders and is a useful tool in retaining talented employees; |

•Is linked to execution of our corporate strategies; • | | Is linked to execution of our corporate strategies. Linking a significant portion of our executives’ total pay to the successful execution of our strategies provides an incentive to achieve our objectives for increasing shareholder value; |

•Encourages sound decisions that lead to long-term success and avoid unnecessary or excessive risk; and • | | Allows our executives the opportunity to earn competitive total pay; and |

•Allows our executives the opportunity to earn competitive total pay. • | | Encourages sound decisions that lead to long-term success and avoid unnecessary or excessive risk. |

In structuring annual and long-term incentive compensation opportunities, we select performance measures that we believe significantly drive the value of our company. For awards made in 2016, we selected a combination of incentive performance measures that focus on driving operating earnings and rewarding the appropriate use of capital, and include a relative shareholder return measure to evaluate our performance relative to a peer group. We set goals against these measures and make little or no payment for poor performance against our goals, though our executives can earn significant payment relative to their salary levels for superior performance against them. We make annual awards of restricted stock units which vest after three years, both to encourage retention and to provide an incentive for performance to increase the value of our shares. While we generally set measures based on company-wide performance (and for this purpose we include ourde-consolidated Garlock Sealing Technologies LLC (“GST”) subsidiary in our results as if it were reconsolidated), for annual incentive awards to divisional personnel, 75% of the award is based on the respective division’s performance with the remaining 25% is based on company-wide performance. We believe that this weighting toward divisional performance not only improves theline-of-sight for the incentives to employees in our divisions, but appropriately recognizes and rewards collaboration of divisional personnel across the company.

We believehave structured our compensation structure alignsprograms to align with the interests of our shareholders and results in payment based on our performance.

We routinely engage with our shareholders and have addressed theirto discuss any concerns about our compensation programs ThroughThroughout the course of each year, we have dialoguesspeak with numerous shareholders, including regularfrequent conversations with many of our largest shareholders. WeThese conversations cover a wide range of topics, in these discussions, including executive compensation. Inour strategic direction, financial performance, future growth opportunities, capital allocation strategy, and management practices. During these conversations in 2019, our shareholders generally supportsupported our paycompensation practices and strategic direction.policies. We communicated the investor feedback on our

compensation practices to the Compensation and Human Resources Committee and take theirshareholder views into account as we seek to align our policies and practices with their interests. We employ best practices in executive compensation •We balance short-term and long-term compensation to discourage short-term risk-taking at the expense of long-term results. •We align the interests of our executive officers with the interests of our shareholders. We require our officers to own and retain meaningful amounts of EnPro stock and to increase their ownership as their levels of responsibility increase. •Our Compensation and Human Resources Committee relies on an independent executive compensation consultant to evaluate our compensation plans. The consultant reports directly to the committee and provides no other services to our company. •We have limited perquisites. No employee receives special perquisites.

•We generally make compensation decisions and grant equity and other compensation awards only on an annual basis, with interim adjustments and awards only in unusual circumstances, such as in connection with a material change in an executive officer’s responsibilities. •Our policies prohibit executives from hedging ownership of EnPro stock and limit executives in pledging EnPro stock. •Our clawback policy entitles us to recover performance-based compensation from any executive officer whose fraud or willful misconduct requires a material restatement of our financial results. Changes in 2016

We made the following changes to our compensation program in 2016:

• | | Redesigned our long-term incentive compensation awards, with payments under 2016 awards payable in cash based on our adjusted return on invested capital over the three-year (2016-2018) performance period and the number of shares to be issued under the awards payable in stock being based on our total shareholder return (or TSR) over the same three-year period relative to TSR of the S&P SmallCap 600 Capital Goods (Industry Group) Index over that period; |

• | | Reduced the maximum payout on long-term incentive compensation awards from 300% to 200%; |

• | | Reduced the portion of long-term compensation awarded as restricted stock units from 40% to 33 1/3%; |

• | | Provided for “double triggers” forchange-in-control vesting for new long-term incentive and equity awards; and |

• | | Increased the weighting of divisional performance for annual incentive awards to divisional personnel. |

Compensation analysis Our compensation program ties incentive compensation pay to the achievement of both annual and long-term goals for the performance of our company. We set these goals each year and tie both annual and three-year incentive awards to achieving them. We make little or no incentivebelieve our compensation structure aligns with the interests of our shareholders and resulted in payment for poorcommensurate with our performance. The amount of awards paid under our annual performance against our goals, but our executives can earn significant paymentplan is based on performance relative to their salary levels for superior performance against them.

When 2016 annual operating performance goals were set, we anticipated a continuation of economic trends that had adversely affected a number of the markets we serve, particularly oilthreshold, target and gas, trucking and metals and mining. The Committee established target corporatemaximum performance levels for 2016 that it considered aggressive in lightset when the awards are made. When performance falls below the threshold, executives receive no payout. Payouts at a threshold level of the circumstances. The extent of the adverse trends during 2016 was greater than we had expected. Nearly all of the markets that we serve saw negative year-over-year trends, and our sales have closely tracked those trends. As a result, the year did not progress as we had expected and payouts for corporate-level annual performance awards were only 80.8%are 50% of the target amount.

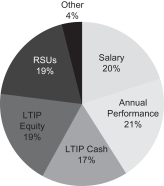

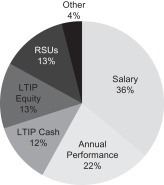

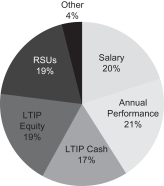

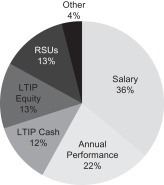

payout, payouts at a target level of performance are 100% of the target payout, and payouts at a maximum level of performance are at 200% of the target payout. For 2019, the performance measures and weightings for the annual performance plan were adjusted EBITDA and adjusted return on invested capital (or “adjusted ROIC”), which performance measures are described on page 35. The following charts show the relative weighting of these performance measures in our 2019 annual incentive compensation awards and the level of our actual payout performance level against the target level of performance for these awards (target level being reflected at 100%) and the resulting payout level against the target payout level. | | | Annual Incentive Compensation Analysis | Performance Measures | | Actual Performance vs. Target; Payout |

In February of each year, we make long-term compensation awards to our executive officers. In 2019, these long-term compensation awards were made in the form of both long-term incentive compensation awards (“LTIP awards”) payable in cash and payable in stock, with payouts based on performance measured over a three-year performance cycle, and restricted stock units which vest, subject to continued employment, three years after the date of grant. Like the annual incentive awards, the LTIP award payouts are based on achievement with respect to performance measures established when the awards are made. Payouts at a threshold level of performance are 50% of the target payout, payouts at a target level of performance are 100% of the target payout, and payouts at a maximum level of performance are at 200% of the target payout. Similar awards were made in February 2017 for the 2014-2016three-year performance cycle that ended on December 31, 2019. In July 2019, in connection with his appointment as President and Chief Executive Officer effective on July 29, 2019, we established absolute goalsawarded Marvin Riley an additional LTIP award payable in stock, having the same terms and conditions, including performance measures, periods and targets, as the awards granted to him and the other executive officers in February 2019. We also awarded him stock options to purchase 40,937 shares of common stock at an exercise price equal to the closing price per share of the company’s common stock on the date of the award. The stock options vest and become exercisable, subject to Mr. Riley’s continued employment, in equal installments on the third, fourth and fifth anniversaries of the date of grant. These awards and other adjustments to Mr. Riley’s compensation in connection with his promotion in July 2019 are discussed in greater detail on pages 34 and 35. We made these additional long-term compensation awards to Mr. Riley to reflect his increased responsibilities and to further incent performance and to provide for growthhis retention. In February 2020, the Compensation and Human Resources Committee of equity value above targeted returns and calculated equity value based on a multipleour board of adjusted EBITDA. Our abilitydirectors certified the level of performance with respect to grow adjusted EBITDA is dependentthe LTIP awards made in part on economic conditions in the markets we serve, which, with limited exceptions, have been sluggish duringFebruary 2017 for the three-year measurement periodperformance cycle that ended on December 31, 2019. The performance measure for these awards. Principally asthe LTIP awards payable in cash was adjusted ROIC, which return measure included goodwill and other intangible assets. The performance measure for the LTIP awards payable in stock was our total shareholder return compared to the same measure of a result of these economic conditions, we were unable to achieve growthstock index that includes our company (rTSR). These performance measures are described in adjusted EBITDA at a rate sufficient to trigger any payout for these awards. As a result, the incentive award payouts to our CEO were 74% lower for 2016 than for 2015, and his total compensation, as reported in the Summary Compensation Table includedgreater detail on page 41,36. Similar performance measures were used for the LTIP awards granted in February 2019.

The following charts illustrate the allocation of value among the LTIP awards payable in stock, LTIP awards payable in cash and restricted stock units (RSUs) awarded to executive officers in February 2019 (which does not include the special awards made to Mr. Riley in July 2019 described above) and the actual performance level and payout level relative to the respective target levels (shown at 100%) of the LTIP awards made to the executive officers for the three-year performance cycle that ended on December 31, 2019 (performance on the measure for LTIP awards payable in stock was 21% lowerbelow threshold resulting in no payout and performance on the measure for 2016 compared to 2015.LTIP awards payable in cash exceeded the maximum level resulting in 200% payout). | | | Long-Term Incentive Compensation Analysis | Allocation of 2019 Long-Term

Compensation Awards | | 2017-2019 LTIP Awards

Actual Performance vs. Target; Payout |

FrequencyApproval of shareholder votes to approve executive compensationthe EnPro Industries, Inc. 2020 Equity Compensation Plan

See “Proposal 3 — Advisory vote onApproval of the frequency of future shareholder advisory votes to approve the compensation of our named executive officers”2020 Equity Compensation Plan” (page 56) for more information. Under the Dodd-Frank Act, we are required to provide shareholders with the opportunity, at least every six years, to cast anon-binding, advisory vote on whether future advisory votes on executive compensation should be held every one year, every two years or every three years. Shareholders last voted on such a proposal at the 2011 annual meeting, and more votes were cast atWe ask that meeting in favor of having advisory shareholder votes to approve executive compensation every one year than were cast in favor of any of the other alternatives. Since 2011, we have provided our shareholders an opportunity

at each annual meeting to cast votes on an advisory resolution to approve the compensation paid toEnPro Industries, Inc. 2020 Equity Compensation Plan (the “2020 Equity Compensation Plan”), which was approved by our named executive officers as disclosed in our proxy statement for that meeting. Our board of directors, continuessubject to believe thatshareholder approval, on February 19, 2020. If the frequency2020 Equity Compensation Plan is approved by our shareholders, it will authorize the issuance of every “1 Year”up to 1,000,000 shares of our common stock for the advisory vote on executive compensation isgrant of awards under the optimal interval for conducting2020 Equity Compensation Plan.

The 2020 Equity Compensation Plan will replace our Amended and responding to such advisory votesRestated 2002 Equity Compensation Plan (the “Prior Plan”), and recommends that you vote for the option of every “1 Year” for the frequency of future advisory votes on executive compensation. Approval of annual and long-term incentive compensation plans

See “Proposal 4 — Approval of our amended and restated Senior Executive Annual Performance Plan” (page 57) and Proposal 5 — Approval of our amended and restated Long-Term Incentive Plan” (page 61) for more information.

At the annual meeting, shareholdersno new awards will be asked to consider and approve in separate votes our amended and restated Senior Executive Annual Performancegranted under the Prior Plan. Any awards outstanding under the Prior Plan (the “Annual Plan”) and our amended and restated Long-Term Incentive Plan (the “LTIP”) which have been established byon the Boarddate of Directors for certain executive officers. Under Section 162(m) of the Internal

Revenue Code, as amended (the “Code”), periodic shareholder approval of the Annual2020 Equity Compensation Plan will remain subject to and be paid under the Prior Plan, and any shares subject to outstanding awards under the Prior Plan that subsequently expire, terminate, or are surrendered or forfeited for any reason without issuance of shares will automatically become available for issuance under the 2020 Equity Compensation Plan.

Our Board recommends that shareholders approve the 2020 Equity Compensation Plan. The purposes of the LTIP is required2020 Equity Compensation Plan include to: •enhance our ability to attract and retain highly qualified officers, non-employee directors, key employees, consultants, and advisors; and •motivate those officers, non-employee directors, key employees, consultants, and advisors to serve our company and to expend maximum effort to improve our business results and earnings by providing an opportunity to acquire or increase a direct proprietary interest in our operations and future success. The 2020 Equity Compensation Plan allows us to promote greater ownership by officers, non-employee directors, key employees, consultants and advisors in order to align their interests more closely with the interests of our shareholders. Shareholder approval of the 2020 Equity Compensation Plan will also enable us to obtaingrant awards under the 2020 Equity Compensation Plan that are designed to qualify for special tax treatment under Section 422 of the Internal Revenue Code. Key features The following features of the 2020 Equity Compensation Plan will protect the interests of our shareholders: •Limitation on terms of stock options and stock appreciation rights. The maximum term of each stock option and stock appreciation right, or SAR, is ten (10) years. •No repricing or grant of discounted stock options or SARs. The 2020 Equity Compensation Plan does not permit the repricing of options or SARs either by amending an existing award or by substituting a new award at a lower price. The 2020 Equity Compensation Plan prohibits the granting of stock options or SARs with an exercise price less than the fair market value of the common stock on the date of grant. •No reloads of options and SARs. The 2020 Equity Compensation Plan prohibits the grant of options or SARs that include a “reload” feature. •No single-trigger acceleration, “liberal” change in control definition, or excise tax deductiongross-ups. Under the 2020 Equity Compensation Plan, we do not automatically accelerate vesting of awards in connection with a change in control of our company. The 2020 Equity Compensation Plan does not include a “liberal” change in control definition or provide change in control excise tax gross-ups. •No liberal share counting. The 2020 Equity Compensation Plan does not include provisions frequently labeled as “liberal share counting” (i.e., the ability to re-use shares tendered or surrendered to pay the exercise cost or tax obligation of grants or the “net counting” of shares for stock option or SAR exercises). The only share re-use provisions are for awards paidthat are canceled or forfeited or for awards settled in cash. •Clawbacks. Awards granted under the respective plan2020 Equity Compensation Plan are subject to certain of our executive officers whose compensation for the taxable year is in excess of $1 million. Our shareholders last approved a version of the Annual Planrecovery policies, including EnPro’s Executive Compensation Recovery (Clawback) Policy. •Dividends. We will not pay dividends or dividend equivalents on stock options, SARs or on other unearned awards (both time-vesting and the LTIP in 2012. The provisions of Section 162(m) of the Code require that the Annual Plan and the LTIP be reapproved by shareholders at least every five years in order for us to continue excluding the amounts paid under the Annualperformance-vesting).

•Minimum vesting requirements. The 2020 Equity Compensation Plan and the LTIP from the $1 million deductibility limit. Therefore, shareholdersincludes minimum vesting requirements. Awards generally cannot vest earlier than one year after grant. Certain limited exceptions are being requested to again approve the Annual Plan and the LTIP.permitted. Auditors

See “Proposal 6 — 4—Ratification of PricewaterhouseCoopers LLP as our company’s independent registered public accounting firm for 2017”2020” and “Independent registered public accounting firm” (page 66)62) for more information. We ask our shareholders to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017.2020. The information below summarizes PricewaterhouseCoopers’ fees for services provided for calendar years 20162019 and 2015.2018. | | | | | | Year ended December 31 | | 2019 | | | 2018 | Audit fees | | $2,686,128 | | $2,342,500 | Audit-related fees | | 87,900 | | 37,900 | Tax fees | | — | | — | All other fees | | 2,900 | | 2,900 | Total | | $2,776,928 | | $2,383,300 |

| | | | | | | | | | Year ended December 31 | | 2016 | | | 2015 | | Audit fees | | $ | 2,204,500 | | | $ | 1,901,600 | | Audit-related fees | | | 10,600 | | | | 10,600 | | Tax fees | | | — | | | | 18,375 | | All other fees | | | 2,000 | | | | 2,000 | | | | | | | | | | | Total | | $ | 2,217,100 | | | $ | 1,932,575 | | | | | | | | | | |

The enclosed proxy is solicited on behalf of the board of directors of EnPro Industries, Inc., in connection with our 20172020 annual meeting of shareholders. The meeting will be held on Wednesday, April 26, 2017,29, 2020, at 11:30 a.m. at The Sanctuarythe company’s headquarters located at Kiawah Island, One Sanctuary Beach Drive, Kiawah Island, South Carolina 29455.5605 Carnegie Boulevard, Suite 500, Charlotte, North Carolina. You may use the enclosed proxy card to vote your shares whether or not you attend the meeting. Please vote by following the instructions on the card. Because your vote is very important, we encourage you to cast it promptly by telephone or over the Internet, or by dating, signing and returning your proxy card in the enclosed envelope. Submitting your proxy in any of these manners means your shares of our common stock will be voted as you specify by the individuals named on the proxy card. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully. We are mailing our 20162019 annual report, including financial statements, with this proxy statement to all shareholders who hold shares directly in their own names. We will begin mailing materials to these registered shareholders on or around March 23, 2017.26, 2020. If you are a beneficial owner whose shares are held in street name in an account at a bank, securities broker or other nominee, you should receive the annual report, proxy statement and a proxy card directly from the nominee. Any shareholder may request additional copies of these materials from our shareholder relations department, which can be reached via email atinvestor@enproindustries.comor by calling704-731-1522. 704-731-1527. What is the purpose of the annual meeting? At our annual meeting, shareholders will act on the following proposals: •Election of eightnine directors; •Adoption of an advisory resolution approving the compensation paid to our named executive officers as disclosed in this proxy statement; Selection, on an advisory basis,•Approval of the frequency of future shareholder advisory votes to approve executive compensation;

2020 Equity Compensation Plan; andApproval of our Annual Plan as described in this proxy statement;

Approval of our LTIP as described in this proxy statement; and

•Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017. 2020.Our board of directors has submitted these proposals. We are not aware of any other business to be addressed at the meeting; however, other business may be addressed if it properly comes before the meeting. Who is entitled to vote at the meeting? You may vote if you owned EnPro common stock as of the close of business on the record date, March 9, 2017.13, 2020. Each share of common stock is entitled to one vote on each matter considered at the meeting. At the close of business on the record date, 21,414,88120,582,648 shares of EnPro common stock were outstanding and eligible to vote. The amount does not include 193,699185,764 shares held by an EnPro subsidiary. Who canmay attend the meeting? AnyoneHolders of EnPro common stock whose shares are recorded directly in their names in our stock register (“shareholders of record”) at the close of business on March 13, 2020 may attend the meeting. In addition, shareholders who ownshold shares of our common stock in “street name,” that is, through an account with a broker, bank, trustee, or other holder of record, as of the recordsuch date may attend. This includes all registered shareholders (or their duly appointed representatives) and beneficial ownersattend the meeting by presenting satisfactory evidence of ownership as of the March 13, 2020 record date. Our invited guests may also attend the meeting.

Are there any special instructions for attending the meeting?

At the security gate at the entrance of the Kiawah Island property you will be required to inform the security personnel that you plan to attend the EnPro Industries annual meeting of shareholders to be held at The Sanctuary. You will be given a vehicle pass to gain access to the Kiawah Island property that will permit you to park in the parking lots located adjacent to The Sanctuary facility. Signage at The Sanctuary will direct you to the room in which the meeting will be held.

How do I vote? Registered shares:Shareholders of record: Registered shareholdersShareholders of record have four voting options:

•over the Internet at the internet address shown on the enclosed proxy card; •by telephone through the number shown on the enclosed proxy card; •by completing, signing, dating and returning the enclosed proxy card by mail; or •in person at the meeting. Even if you plan to attend the meeting, we encourage you to vote your shares by submitting your proxy. If you choose to vote your shares at the meeting, please bring proof of stock ownership and proof of your identity for entrance to the meeting. Beneficial shares:Shareholders owning shares in street name: If you hold your EnPro shares in street name, your ability to vote by Internet or telephone depends on the voting process of the bank, broker or other nominee through which you hold the shares. Please follow their directions carefully. If you want to vote at the meeting, you must request a legal proxy appointment from your bank, broker or other nominee and present that legal proxy appointment, together with proof of your identity, for entrance to company officials as you attend the meeting.

Every vote is important! Please vote your shares promptly. How do I vote my 401(k) shares? If you hold EnPro shares in the company’s 401(k) plan, the plan’s trustee will vote your shares according to the instructions you provide when you complete and submit the proxy instructions you receive from the plan manager. If you hold EnPro shares in both an EnPro 401(k) plan and are also a shareholder of record with shares in a registered account outside the plan, and if your plan information matches the information we have on your registered account, you will receive one proxy card representing all shares you own. If you hold EnPro shares outside the plan in street name, or if your registered account information is different from your plan account information, you will receive separate proxies, one for shares you hold in the plan and one for shares you hold outside the plan. What can I do if I change my mind after I vote my shares? Even if you have submitted your vote, you may revoke your proxy and change your vote at any time before voting begins at the annual meeting. Registered shareholders:Shareholders of record: Registered holdersShareholders of record may change their votes in one of two ways:

•by voting on a later date by telephone or over the Internet (only your last dated proxy card or telephone or Internet vote is counted); or •by delivering a later dated proxy card to our Secretary, either prior to or at the meeting; or by voting your shares in person at the meeting. In order to vote your shares at the meeting, you must specifically revoke a previously submitted proxy. Beneficial shareholders:Shareholders owning shares in street name: If you hold your shares in street name, you should contact your bank, broker or other nominee to find out how to revoke your proxy.

Is there a minimum quorum necessary to hold the meeting? A quorum is established when the majority of EnPro shares entitled to vote are present at the meeting in person or by proxy. Abstentions and broker“non-votes” “non-votes” are counted as present and entitled to vote for purposes of establishing a quorum. If you return valid proxy instructions or vote in person at the meeting, you will be considered part of the quorum. How will my vote be counted? If you return your proxy card with specific voting instructions or submit your proxy by telephone or the Internet, your EnPro shares will be voted as you have instructed. If you are a registered shareholder of record and submit a proxy by mail, telephone or the Internet without specific voting instructions, your shares will be voted according to our board of directors’ recommendations. If you do not submit valid proxy instructions or vote in person at the meeting, your shares will not be voted. If you are a beneficial shareholderhold your shares in street name and do not give your bank, broker or other nominee instructions for voting your shares, your shares will be considered to be “uninstructed.” Your nominee generally has the authority to vote “uninstructed” shares at its discretion only on matters that are “routine” under the rules of the New York Stock Exchange (NYSE). For our 20172020 meeting, only the ratification of our independent accounting firm (Proposal 6)3) is considered routine by the NYSE. The election of directors and matters related to executive compensation are not considered routine. Without your instruction, your shares will not be voted in these matters (Proposals 1 through 5)and 2). What vote is required to approve each item? Proposal 1: Election of directors.Directors are elected by a plurality of the votes cast in person or by proxy at the meeting. “Plurality” means that the director nominees who receive the largest number of votes cast are elected, up to the eightnine directors to be elected at the meeting.Un-voted shares will have no impact on the election of directors. Unless a proxy includes proper instructions to “Withhold” a vote for any or all nominees, the proxy will be voted “For” each of the nominees. In an uncontested election, any nominee who receives more “Withhold” votes than votes “For” must promptly offer his or her resignation. The Nominating and Corporate Governance Committee will review the resignation and recommend a course of action to the board. The full board, excluding the resigning director, will act within 90 days after the shareholders meeting to accept or reject the resignation. The board’s decision and an explanation of the process used to reach it will be disclosed publicly on Form8-K. Proposal 2: Advisory vote to approve executive compensation.The advisory resolution to approve the compensation paid to our named executive officers will be approved if more votes are cast “For” the resolution than are cast “Against” it. Although this advisory vote is not binding under applicable law, our board will review the results and take them, and the views expressed by our shareholders, into account in determining our executive compensation practices. Proposal 3. Selection of frequency of future shareholder advisory votes to approve executive compensation. The frequency of the advisory vote on executive compensation receiving the greatest number of votes (every one year, every two years or every three years) will be considered the preference selected by the shareholders. Although this advisory vote isnon-binding, as provided by law, our board will review the results of the vote and, consistent with our record of shareholder engagement, will take it into account in making determinations concerning the frequency of future advisory votes on executive compensation. Proposal 4:3: Approval of the Annual Plan2020 Equity Compensation Plan. . The Annual2020 Equity Compensation Plan will be approved if morea majority of the votes cast on the proposal are cast “For” the proposal than are cast “Against” it.approval.

Proposal 5: Approval of the LTIP.The LTIP will be approved if more votes are cast “For” the proposal than are cast “Against” it. Proposal 6:4: Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020. 2017.The ratification of the appointment of our independent accounting firm will be approved if more votes are cast “For” the proposal than are cast “Against” it.

Other business. Any other business that properly comes before the meeting, or any adjournment of the meeting, will be approved if more votes are cast “For” the proposal than “Against” the proposal. How do brokernon-votes and abstentions count for voting purposes? “Brokernon-votes” arise when beneficial shareholders who hold shares in street name do not give their banks, brokers or other nominees instructions for voting their shares and the banks, brokers or other nominees do not have authority to vote the shares on a matter because the matter is not routine. Abstentions and brokernon-votes will count for determining whether a quorum is present for the meeting. Because directors are elected by a plurality of the votes cast, brokernon-votes and abstentions will not count in determining the outcome of the election of directors. For all other proposalsBecause the applicable rules of the NYSE require approval of the 2020 Equity Compensation Plan by a majority of the votes cast on the agenda forproposal, abstentions, which will be considered to be votes “cast,” will have the annual meetingeffect of a vote “Against” approval, and broker non-votes, which are not considered to be votes “cast,” will not count in determining the outcome. For the advisory vote on executive compensation, the ratification of the appointment of our independent accounting firm and with respect to any other business as may properly come before the meeting or any adjournment of the meeting, only votes “For” or “Against” the proposal count—accordingly, brokernon-votes, if any, and abstentions will not be counted in determining the outcome of the votes on those proposals. Is there a list of shareholders of record entitled to vote at the annual meeting? You may examine a list of the shareholders of record entitled to vote at the annual meeting. The list will be available at our offices at 5605 Carnegie Boulevard, Suite 500, Charlotte, North Carolina, from March 23, 201726, 2020 through the end of the meeting and will also be available at the location of the annual meeting during the annual meeting. What are the board’s recommendations? Your board of directors recommends that you vote: •“FOR” each of our nominees to the board of directors; •“FOR” the advisory resolution approving the compensation paid to our named executive officers as disclosed in this proxy statement; For every •“1 YEAR” in the advisory vote on the frequency of future shareholder advisory votes to approve executive compensation;

“FOR” the approval of the Annual Plan as described in this proxy statement;

2020 Equity Compensation Plan; and•“FOR” the approval of the LTIP as described in this proxy statement; and “FOR” ratifying PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017.

2020.If you return a valid proxy card or respond to our proxy by telephone or Internet and do not include instructions on how you want to vote, your shares will be voted in accordance with the board’s recommendations. How can I find out the results of the vote? We will publish final voting results in a report onForm 8-K8K to be filed with the Securities and Exchange Commission (SEC)(the “SEC”) within four business days after the meeting. We will also post the voting results on our website,www.enproindustries.com.www.enproindustries.com. What is “householding” and how does it affect me? When two or more shareholders are in the same household and receive mail at the same address, rules adopted by the SEC rules allow us to deliver only one proxy statement and annual report to that address, reducing our cost for preparing and delivering proxy materials. If you fall into this category and would like separate mailings of our proxy statement and annual report, you may request them at no cost to you by contacting us atinvestor@enproindustries.comor by calling704-731-1522. 704-731-1527. Registered shareholders who would like separate mailings in the future (or who would like to consolidate future mailings) may request them using the contact information above. Investors whose shares are held in street name by a bank, broker or other nominee should request separate mailings (or consolidation of mailings) from the nominee. Can I access these proxy materials on the Internet? This proxy statement and our 20162019 annual report to shareholders, which includes our 2016 annual report2019 Annual Report onForm 10-K, are available athttp:https://www.enproindustries.com/www.enproindustries.com/shareholder-meeting. Registered shareholdersShareholders of record whose shares are held directly in their names in our stock register can choose to receive these documents over the Internet in the future by accessingwww.proxyvote.comand following the instructions provided on that website. Choosing to receive your materials over the Internet gives you full access to all materials and saves us printing and mailing expenses. If you make this choice, you will receive ane-mail email prior to next year’s meeting notifying you that our proxy materials and annual report are available for online review. Thee-mail email will also include instructions for electronic voting. Should you desire to end electronic delivery and again receive paper copies of the materials, please notify us by letter to 5605 Carnegie Boulevard, Suite 500, Charlotte, North Carolina 28209, Attention: Shareholder Relations.

Beneficial ownersShareholders who hold their shares in street name should request instructions for receiving future proxy statements and annual reports over the Internet from their bank, broker or other nominee.

Who will solicit votes and pay for the costs of this proxy solicitation?solicitation? We will pay the costs of the solicitation. Although our officers, directors and employees may personally solicit proxies, they will not receive any additional compensation for doing so. We may also solicit proxies by issuing press releases, posting information on our website,www.enproindustries.com, and placing advertisements in periodicals or on websites. D.F. King & Co. is assisting us in the solicitation of proxies and provides us with advice and support related to solicitation. We do not expect the total costs to us for D.F. King’s services to exceed $20,000. In addition, if banks, brokers and other nominees representing beneficial owners ofshareholders who hold their shares in street name make the request, we will reimburse them for their expenses in forwarding voting materials and obtaining voting instructions from beneficial owners of our shares.these shareholders. Who will count the votes? Broadridge Financial Solutions will act as the master tabulator and count the votes. Beneficial ownership of our common stock; transactionsstock Beneficial owners of 5% or more of our common stock The following table sets forth information about the individuals and entities who heldwhich beneficially owned more than five percent of our common stock as of March 1, 2017.2020. This information is based solely on SEC filings made by the individuals and entities by that date. | | | | | | | | | Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial

Ownership | | | Percent of

Class(1) | | BlackRock, Inc.et al.(2) | | | 2,414,831 | | | | 11.3 | % | 55 East 52nd Street | | | | | | | | | New York, New York 10055 | | | | | | | | | | | | The Vanguard Group, Inc.(3) | | | 1,817,255 | | | | 8.5 | % | 100 Vanguard Blvd. | | | | | | | | | Malvern, Pennsylvania 19355 | | | | | | | | | | | | Silver Point Capital, L.P. et al.(4) | | | 1,750,000 | | | | 8.2 | % | Two Greenwich Plaza | | | | | | | | | Greenwich, Connecticut 06830 | | | | | | | | | | | | Hotchkis and Wiley Capital Management, LLC(5) | | | 1,433,740 | | | | 6.7 | % | 725 S. Figueroa Street, 39th Floor | | | | | | | | | Los Angeles, California 90017 | | | | | | | | |

| | | | | Name and Address of

Beneficial Owner | | Amount and Nature

of Beneficial

Ownership | | Percent of

Class(1) | BlackRock, Inc. et al. (2) | | 3,180,912 | | 15.4% | 55 East 52nd Street | | | | | New York, New York 10055 | | | | | | | | | | The Vanguard Group, Inc. (3) | | 2,183,297 | | 10.6% | 100 Vanguard Blvd. | | | | | Malvern, Pennsylvania 19355 | | | | | | | | | | GAMCO Investors, Inc. et al. (4) | | 1,562,842 | | 7.6% | One Corporate Center | | | | | Rye, New York 10580-1435 | | | | | | | | | | Dimensional Fund Advisors LP (5) | | 1,343,202 | | 6.5% | Building One, 6300 Bee Cave Road | | | | | Austin, Texas 78746 | | | | |

(1) | Applicable percentage ownership is based on 21,425,381 shares of our common stock outstanding at March 1, 2017,(1)Applicable percentage ownership is based on 20,630,419 shares of our common stock outstanding at March 1, 2020, other than shares held by our subsidiaries. |

(2) | This information is based on a Schedule 13G amendment dated January 9, 2017 filed with the SEC by BlackRock, Inc. reporting beneficial ownership as of December 31, 2016. BlackRock, Inc. reports sole voting power over 2,366,951 shares and sole dispositive power over 2,414,831 shares. The Schedule 13G amendment was filed by Blackrock, Inc. as a parent holding company with respect to the following subsidiaries: BlackRock (Netherlands) B.V., BlackRock Advisors, LLC; BlackRock Asset Management Canada Limited; BlackRock Asset Management Ireland Limited; BlackRock Asset Management Schweiz AG, BlackRock Financial Management, Inc., BlackRock Fund Advisors; BlackRock Institutional Trust Company, N.A.; BlackRock Investment Management (Australia) Limited; BlackRock Investment Management (UK) Ltd; and BlackRock Investment Management, LLC. The Schedule 13G amendment indicates that BlackRock Fund Advisors beneficially owns 5% or greater of the outstanding shares of our common stock. |

(3) | This information is based on a Schedule 13G amendment dated February 9, 2017 filed with the SEC by The Vanguard Group, Inc. reporting beneficial ownership as of December 31, 2016. The Vanguard Group, Inc. reports sole voting power with respect to 42,902 shares, shared voting power with respect to 3,588 shares, sole dispositive power with respect to 1,771,877 shares and shared dispositive power with respect to 45,378 shares. The Vanguard Group, Inc. also reports that Vanguard Fiduciary Trust Company, a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 41,790 shares as a result of its serving as investment manager of collective trust accounts and that Vanguard Investments Australia, Ltd., a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 4,700 shares as a result of its serving as investment manager of Australian investment offerings. |

(4) | This information is based on a Schedule 13G dated December 23, 2016 filed with the SEC by Silver Point Capital, L.P., Edward A. Mulé and Robert J. O’Shea reporting beneficial ownership as of December 13, 2016 with respect to the ownership of shares by Silver Point Capital Fund, L.P. and Silver Point Capital Offshore Fund, Ltd. Silver Point Capital, L.P. reports sole voting power with respect to 1,750,000 shares and sole dispositive power with respect to 1,750,00 shares and Mr. Mulé and Mr. O’Shea each report shared voting power with respect to 1,750,000 shares and shared dispositive power with respect to 1,750,00 shares. The Schedule 13G reports that: Silver Point Capital, L.P. is the investment manager of Silver Point Capital Fund, L.P. and Silver Point Capital Offshore Fund, Ltd. and by virtue of such status may be deemed to be the beneficial owner of the securities held by such funds; Silver Point Capital Management, LLC is the general partner of Silver Point Capital, L.P. and as a result may be deemed to be the beneficial owner of the securities held by Silver Point Capital Fund, L.P. and Silver Point Capital Offshore Fund, Ltd.; and each of Mr. Mulé and Mr. O’Shea is a member of Silver Point Capital Management, LLC and has voting and investment power with respect to the securities held by Silver Point Capital Fund, L.P. and Silver Point Capital Offshore Fund, Ltd. and may be deemed to be a beneficial owner of the securities held by Silver Point Capital Fund, L.P. and Silver Point Capital Offshore Fund, Ltd. |

(5) | This information is based on a Schedule 13G amendment dated February 9, 2017 filed with the SEC by Hotchkis and Wiley Capital Management, LLC (“HWCM”) reporting beneficial ownership as of December 31, 2016. HWCM reports sole voting power with respect to 1,197,320 shares and sole dispositive power with respect to 1,433,740 shares. HWCM also reports that: such shares are owned of record by clients of HWCM; those clients have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, such shares; no such client is known to have such right or power with respect to more than five percent of the outstanding shares of our common stock; and it disclaims beneficial ownership of such shares pursuant to Rule13d-4 under the Securities Exchange Act of 1934, as amended. |

(2)This information is based on a Schedule 13G amendment dated February 3, 2020 filed with the SEC by BlackRock, Inc. reporting beneficial ownership as of December 31, 2019. BlackRock, Inc. reports sole voting power over 3,132,615 shares and sole dispositive power over 3,180,912 shares. The Schedule 13G amendment was filed by Blackrock, Inc. as a parent holding company with respect to the following subsidiaries: BlackRock Advisors, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock Investment Management (Australia) Limited, BlackRock (Netherlands) B.V., BlackRock Fund Advisors, BlackRock Asset Management Ireland Limited, BlackRock Institutional Trust Company, National Association, BlackRock Financial Management, Inc., BlackRock Asset Management Schweiz AG and BlackRock Investment Management, LLC. The Schedule 13G amendment indicates that BlackRock Fund Advisors and iShares Core S&P Small-Cap ETF beneficially own 5% or greater of the outstanding shares of our common stock. (3)This information is based on a Schedule 13G amendment dated February 10, 2020 filed with the SEC by The Vanguard Group, Inc. reporting beneficial ownership as of December 31, 2019. The Vanguard Group, Inc. reports sole voting power with respect to 22,014 shares, shared voting power with respect to 3,588 shares, sole dispositive power with respect to 2,160,504 shares and shared dispositive power with respect to 22,793 shares. The Vanguard Group, Inc. also reports that Vanguard Fiduciary Trust Company, a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 19,205 shares as a result of its serving as investment manager of collective trust accounts and that Vanguard Investments Australia, Ltd., a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 6,397 shares as a result of its serving as investment manager of Australian investment offerings. (4)This information is based on a Schedule 13D amendment dated December 31, 2018 filed with the SEC by GAMCO Investors, Inc., Mario J. Gabelli (“Mario Gabelli”) GGCP, Inc. (“GGCP”), Associated Capital Group, Inc. (“AC”), Gabelli Funds, LLC (“Gabelli Funds”), GAMCO Asset Management Inc. (“GAMCO”), Gabelli & Company Investment Advisers, Inc. (“GCIA”), MJG Associates, Inc. (“MJG Associates”) and Gabelli Foundation, Inc. (the “Foundation”) reporting beneficial ownership as of December 28, 2018. The Schedule 13D amendment reported that the principal business office of GGCP and MJG Associates is 140 Greenwich Avenue, Greenwich, Connecticut 06830, and the principal business office of the Foundation is 165 West Liberty Street, Reno, Nevada 89501. The Schedule 13D amendment reported that, as of December 28, 2018, Gabelli Funds had sole voting and sole dispositive power with respect to 323,362 shares, GAMCO had sole voting power with respect to 1,082,396 shares and sole dispositive power with respect to 1,203,396 shares, MJG Associates had sole voting power and sole dispositive power with respect to 20,800 shares, GCIA had sole voting power and sole dispositive power with respect to 2,600 shares, the Foundation had sole voting power and sole dispositive power with respect to 8,000 shares, GGCP had sole voting power and sole dispositive power with respect to 3,684 shares, and AC had sole voting power and sole dispositive power with respect to 1,000 shares. The Schedule 13D amendment further reported that Mario Gabelli is deemed to have beneficial ownership of the shares owned beneficially by each of the entities listed in the immediately preceding sentence. (5)This information is based on a Schedule 13G amendment dated February 12, 2020 filed with the SEC by Dimensional Fund Advisors LP reporting beneficial ownership as of December 31, 2019. Dimensional Fund Advisors LP reports sole voting power over 1,305,079 shares and sole dispositive power over 1,343,202 shares in its role as investment advisor to certain investment companies or as investment manager to certain commingled funds, group trusts and separate accounts which own such shares. In its Schedule 13G amendment, Dimensional Fund Advisors LP disclaims beneficial ownership of these shares. Director and executive officer ownership of our common stock The following table sets forth information as of March 1, 20172020 about the shares of our common stock beneficially owned by our directors and the executive officers listed in the summary compensation table included in this proxy statement, as well as the shares of our common stock that our current directors and executive officers own as a group. It also includes information regarding the number of phantom shares payable in cash and deferred stock units held by our directors payable in shares. These phantom shares and deferred stock units are not included in the number of shares beneficially owned, but reflect the economic interests of our directors in our common stock. | Name of Beneficial Owner | | Amount and Nature

of Beneficial

Ownership of

Shares(1) | | | Directors’

Phantom

Shares(2) | | | Directors’

Stock

Units(3) | | | Percent of

Class(4) | | | Amount and Nature

of Beneficial

Ownership of

Shares(1) | | Directors’

Phantom

Shares(2) | | Directors’

Stock

Units(3) | | Percent of

Class(4) | Stephen E. Macadam | | | 278,952 | | | | — | | | | — | | | | 1.3 | % | | Marvin A. Riley | | | 19,951 | | — | | — | | * | Thomas M. Botts | | | 10,958 | | | | — | | | | 2,666 | | | | * | | | 16,043 | | — | | 2,776 | | * | Felix Brueck | | | 7,187 | | | | — | | | | 3,960 | | | | * | | | 12,161 | | — | | 7,700 | | * | B. Bernard Burns, Jr. | | | 16,004 | | | | — | | | | — | | | | * | | | 21,134 | | — | | — | | * | Diane C. Creel | | | 16,015 | | | | — | | | | — | | | | * | | | 21,353 | | — | | — | | * | Gordon D. Harnett | | | 21,787 | | | | 15,925 | | | | 6,683 | | | | * | | | Adele M. Gulfo | | | 3,875 | | — | | — | | * | David L. Hauser | | | 18,844 | | | | 4,172 | | | | 7,707 | | | | * | | | 22,503 | | 4,343 | | 8,022 | | * | John Humphrey | | | 5,461 | | | | — | | | | — | | | | * | | | 10,322 | | — | | 5,579 | | * | Kees van der Graaf | | | 10,432 | | | | — | | | | — | | | | * | | | 15,531 | | — | | — | | * | J. Milton Childress II | | | 28,499 | | | | — | | | | — | | | | * | | | 41,027 | | — | | — | | * | Marvin A. Riley | | | 8,742 | | | | — | | | | — | | | | * | | | Robert S. McLean | | | 19,182 | | | | — | | | | — | | | | * | | | 26,960 | | — | | — | | * | Former Executive Officers | | | | | | | | | | Kenneth D. Walker(5) | | | 24,408 | | | | — | | | | — | | | | * | | | Jon A. Cox(6) | | | 38,239 | | | | — | | | | — | | | | * | | | 20 directors and executive officers as a group | | | 552,905 | | | | 20,097 | | | | 21,016 | | | | 2.6 | % | | William C. O’Neal | | | 6,725 | | — | | — | | * | Steven R. Bower | | | 7,410 | | * | | | | | Former Chief Executive Officer | | | | Stephen E. Macadam | | | 256,226 | | — | | — | | 1.2% | 15 current directors and executive officers as a group | | | 140,205 | | 4,343 | | 22,077 | | * |

(1) | These numbers include the following shares that the individuals may acquire within 60 days after March 1, 2017 pursuant to outstanding phantom share awards payable in shares immediately upon termination of service as a director: Mr. Botts, 8,858 shares; Mr. Brueck, 6,187 shares; Mr. Burns, 9,979 shares; Ms. Creel, 15,015 shares; Mr. Harnett, 18,727 shares; Mr. Hauser, 18,022 shares; Mr. Humphrey, 3,461 shares; Mr. van der Graaf, 9,232 shares; and all directors and executive officers as a group, 89,481 shares. These numbers include the following shares that the individuals may acquire within 60 days after March 1, 2017 through the exercise of stock options: Mr. Macadam, 49,505 option shares and the same number of option shares for all directors and executive officers as a group. The numbers also include 1,095 shares held in our Retirement Savings Plan for Salaried Employees allocated to Mr. Childress, 412 shares allocated to Mr. McLean and 3,913 shares in the aggregate allocated to members of all directors and executive officers as a group. The numbers also include 10,402 shares held in an IRA by Mr. Macadam and 12,407 shares in the aggregate held in IRA accounts by all directors and executive officers as a group. The amounts reported do not include restricted stock units as follows: Mr. Macadam, 46,632 restricted stock units; Mr. Childress, 9,196 restricted stock units; Mr. McLean, 6,311 restricted stock units; Mr. Riley, 13,191 restricted stock units; and all directors and executive officers as a group, 100,680 restricted stock units. The amounts reported include the following restricted stock units that are vested but deferred under our Management Stock Purchase Plan: Mr. Macadam, 4,428 shares; Mr. Childress, 89 shares; Mr. McLean, 118 shares; and all directors and executive officers as a group, 1,540 shares. The amounts reported include the following number of shares pledged as security: 100,000 shares by Mr. Macadam and the same number of shares by all directors and executive officers as a group. Such shares are pledged by Mr. Macadam to secure a managed trading program with respect to a broad securities index that does not include any EnPro securities. This pledge transaction was approved in advance in accordance with our policy regarding the pledging of EnPro shares by executive officers, which requires that an executive not pledge shares up to his or her minimum shareholding requirement. |

(2) | These numbers reflect the phantom shares awarded under our Outside Directors’ Phantom Share Plan. When they leave the board, these directors will receive cash in an amount equal to the value of the phantom shares awarded under the Outside Directors’ Phantom Share Plan. See “Corporate Governance Policies and Practices—Director Compensation.” Because the phantom shares are payable in cash, these directors have neither voting nor investment authority in common stock arising from their ownership of these phantom shares and are therefore not deemed to beneficially own shares underlying these awards, though the directors’ economic interests with respect to these awards are equivalent to the economic interests of stock ownership. |

(3) | These numbers reflect the number of stock units credited to thosenon-employee directors who have elected to defer all or a part of the cash portion of their annual retainer and meeting fees pursuant to our Deferred Compensation Plan forNon-Employee Directors. See “Corporate Governance Policies and Practices—Director Compensation.” Because the stock units are not actual shares of our common stock and the directors may not receive the underlying shares within 60 days after March 1, 2017, the directors do not currently beneficially own the underlying shares, though the directors’ investment with respect to these units are equivalent to the economic interests of stock ownership. |

(4) | These percentages do not include the directors’ phantom shares or stock units described in Notes 1 and 2. Applicable percentage ownership is based on 21,425,381 shares of our common stock outstanding at March 1, 2017, other than shares held by our subsidiaries. |

(5) | Information with respect to Mr. Walker is as of December 31, 2016, the date he ceased to be an employee. |

(6) | Information with respect to Mr. Cox is as of October 4, 2016, the date he ceased to be an employee. |